————————————————————————————————

Monthly Discussion

NASDAQ’s Share of the Market

Five

years ago we examined in this Newsletter the progressive growth of NASDAQ on

the expense of NYSE (see Newsletter issue of April 24, 2000).

It

is argued in that issue that NASDAQ had gained market share on NYSE progressively

during the last three decades of the 20th century. These gains followed four consecutive

S-curves according to the usual pattern of sustained growth, namely S-shaped

steps interspersed by horizontal segments (low-growth stagnating periods).

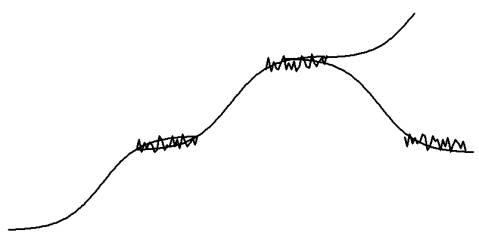

During the low-growth periods between successive

S-curves large fluctuations appear rendering this period rather chaotic see

Exhibit 3 (for a full discussion see Chapters 2&3 of Conquering Uncertainty). It is

during this chaotic period when changes in direction become possible. In fact

chaos scientist refer to this period as bifurcation because the

continuation may upward or downward. In Exhibit 3 we see two successive

growth steps followed by a declining step instead of the desirable third growth

step.

Cascade of Natural Growth Processes

Exhibit

3. A typical pattern of S-curve succession does

not necessarily guarantee sustained growth. Following a chaotic (bifurcation)

period, we may enter a downward rather than an upward new curve.

This is what happened to NASDAQ’s advances over

NYSE. Its last growth phase ended in early 2000 and following a stagnating year

with no growth and much fluctuation (chaotic state) a several-year-long declining

phase set in. This can be seen in Exhibit 4.

NASDAQ $ Volume as % of (NYSE+NASDAQ)

Exhibit 4. S-curves are fit on the data under the assumption that NASDAQ and

NYSE compete for investors’ dollars the same way rabbits compete for grass.

Annual data points are shown here but the analysis is based on daily data.

Monthly data points are shown between May 2000 and May 2004 (white circles).

Four successive upward steps were followed by a downward step. The white dot is

the daily value on February 8, 2005.

Today it seems that the declining phase has been

completed. Even the chaotic stagnating phase following the decline may have

been completed. But whether we are about to witness a new growth phase or

further decline remains questionable. Do not be carried away by the last rising

data point (white dot). My data stopped in May 2004 and the last rise is due to

only a daily value reported on February 8, 2005.

A state of chaos is a period of bifurcation

following which all directions are possible. If you ask my opinion, we are to

remain in the horizontal chaotic state for some time to come.